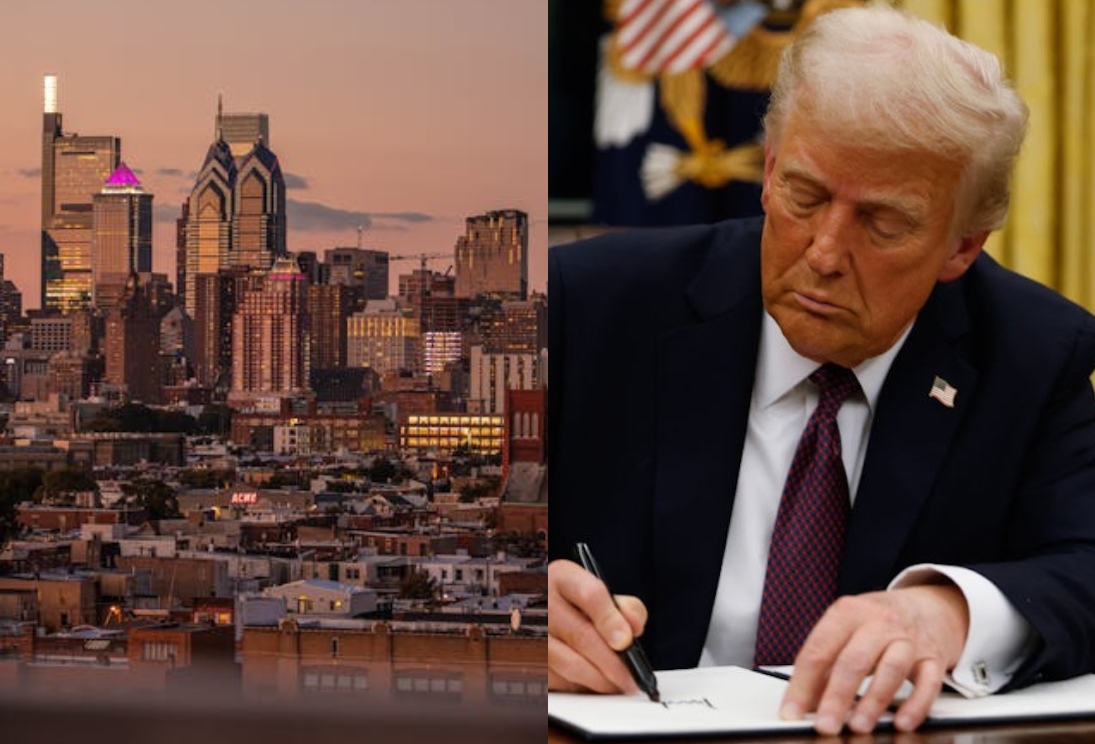

The Philadelphia real estate industry is facing an increasingly uncertain future in light of sweeping new tariffs enacted by the Trump administration. With

inflationary pressures, fluctuating interest rates, and supply chain issues already weighing heavily on developers, the sudden imposition of tariffs on imported construction materials may be the tipping point for many projects throughout the city.

As a firm actively involved in real estate across Philadelphia,

New Age Realty Group has seen firsthand how shifting economic policy can reshape project viability in real time.

The Tariff Breakdown: What Changed?

President Donald Trump announced a

25% tariff on steel and aluminum imports,

along with a

25% tariff on all goods from Canada and Mexico

set to take effect April 2, 2025. These tariffs follow an earlier increase in duties on Chinese imports, now raised to 20%. With the possibility of further escalation against retaliatory trade partners, the construction industry is preparing for what could be a prolonged period of elevated costs.

According to the

Skanska USA Winter Construction Market Report, these tariffs are likely to significantly inflate the cost of construction projects across the U.S., with particularly harsh consequences for mid-sized and urban markets like Philadelphia.

Philadelphia’s Mid-Rise Market Hit Hard

In Philadelphia, developers building mid-rise multifamily housing projects—key to urban revitalization and affordable housing goals—stand to suffer the most. Steel is critical for structural foundations and podiums, while aluminum is widely used for electrical systems and architectural elements such as curtain walls.

Mo Rushdy, managing partner of Riverwards Group and president of the Building Industry Association of Philadelphia, told the

Philadelphia Business Journal, “Simply put, it's just going to kill projects.”

The Compounding Effect of High Interest Rates

The development community was already adapting to the reality of rising interest rates, which jumped from historical lows around 3% to as high as 8% in recent years. Parkway Corp. CEO Rob Zuritsky noted that many developers were just beginning to recalibrate after this shift when the tariffs hit, adding a new layer of uncertainty and expense.

“It’s very, very unsettling. It is uncertainty times five,” Zuritsky said. “This out-of-nowhere jump in the costs is going to set back any new development even further.”

Quantifying the Cost Increases

Alterra Property Group CEO Leo Addimando estimates that just the tariffs on goods from Canada and China could raise construction costs by 5%, citing Canadian timber products as a significant concern. He emphasized that lumber alone makes up a major portion of the cost of building a home, and a 20% increase in the price of lumber would make many projects economically unviable.

According to the Skanska report,

construction costs have risen 41.7% over the past five years and 15.8% over the last three years. Though material prices had begun to flatten—up only 0.7% over the last year—tariffs are expected to reverse that trend, driving prices higher across categories like HVAC systems, drywall, electrical equipment, and finished goods.

“Tariffs will not only increase building costs, but the costs associated with repairing existing structures.

The cost that a supplier pays directly affects retail prices of products they sell," notes Eric Hanson, Property Manager at West Philadelphia's New Age Realty Group. “From a property management standpoint, we’re already bracing for how

this could ripple through repair budgets and tenant experience."

The National Association of Home Builders (NAHB) echoed these concerns in a

recent statement: “Tariffs on essential materials are effectively a tax on housing, threatening to push the dream of homeownership further out of reach for many Americans.”

Philadelphia’s Housing Goals in Jeopardy

Mayor Cherelle Parker has pledged to build or preserve 30,000 housing units during her first term in office. Yet, the path to that goal has become steeper. In 2024, over 8,600 new units were completed citywide. However, 2025 is expected to bring a significant decline in new construction.

Projects already impacted include:

- The Durst Organization’s 26-story apartment tower on the Delaware River, stalled since 2022.

- National Real Estate Development’s withdrawal from plans to redevelop the Family Court building at 1801 Vine Street.

- Parkway Corp.’s decision to pause its 31-story luxury apartment tower at 21st and Ludlow.

Sarah Maginnis, executive director of NAIOP Greater Philadelphia, told the Philadelphia Business Journal, “There’s little doubt that these tariffs will have an adverse impact on construction costs in the Philadelphia region.”

Market Conditions Force Strategic Pivots

The combination of tariffs, interest rates, and lingering supply chain disruptions has left many firms in a holding pattern. Parkway Corp. Vice President Wale Mabogunje explained that his team has previously relied on Canadian steel. “An increase in the cost of materials will inevitably change Parkway’s calculations,” said Zuritsky.

Developers are also contending with the fact that

materials subject to tariffs often make up nearly half the total cost of a project. While domestic production may help mitigate some shortages, ramping up local supply will take time—time many developers don’t have.

With an urgent need for housing and development, industry leaders are calling on policymakers to step in. The City of Philadelphia has a history of working with

housing advisory boards and is expected to explore additional policy interventions in light of current market pressures.

Mo Rushdy put it plainly: “Deals just cannot pencil,” pointing to rising land prices, construction costs, and now, tariffs as the trifecta limiting new housing supply.

Adapting to a New Normal

The real estate community in Philadelphia is no stranger to economic shifts and regulatory hurdles, but the current environment may be among its most complex in decades. Navigating a landscape shaped by trade policy, inflation, and interest rates requires a combination of foresight, creativity, and resilience.

While some developers may delay or cancel projects, others will explore alternative construction methods, pursue new financing structures, or advocate for supportive public policies.

The industry must collaborate, innovate, and adapt to ensure that Philadelphia continues to grow and evolve—even in the face of headwinds.

This article is for informational purposes and reflects market conditions as of March 2025. For insights tailored to your development or investment needs, contact the professionals at

New Age Realty Group, Inc.