First-time Homebuying in 11 Steps (And How to Find an Agent)

Tyler Keough, New Age Realty Group, Inc.

November 19, 2024

Buying your first home is both a huge milestone and a daunting feat. However,

you don't have to navigate the homebuying process alone. We are here to help.

Read on for a complete guide to the first-time homebuying process.

Step 1: Assess Your Needs and Wants & Do Some Market Research

What is the motivation behind wanting to purchase your first home? Are you looking for more space for a growing family? Perhaps you are looking for more financial stability? Whatever the reason, you want to make sure that you consider the lifestyle and long-term goals associated with your motivation to buy your first home.

Our agent, Bob, purchased his first home in 2017 to build a solid foundation to grow his family.

It's also important to consider the current market conditions and any economic factors that could impact buying power and the housing market, such as interest rates and unemployment rates.

Determine whether it's a buyer's or seller's market.

If you are unsure, contact your local real estate agents, who will be more than happy to discuss the market with you.

Step 2: Evaluate Your Financial Readiness

There are a lot of factors that determine your financial readiness to buy your first home.

- Credit Score: Dispute any inaccuracies on your credit reports, and work on improving your score (pay down debts and avoid new lines of credit)

- Income and Employment:

Lenders require proof of stable income, so make sure to gather pay stubs, tax returns, and employment verification

- Budgeting

- Mortgage payments should not exceed 28%

of your monthly gross income

- Total debts should not exceed 36%

of your monthly gross income

- Down payment

should be 20%

of the home's price to avoid private mortgage insurance

- Understanding additional costs of buying

- Closing Costs (Typically 2-5% of the loan amount, covering things like appraisal, title insurance, and attorney fees)

- Property Taxes

- Insurance

- Maintenance

Step 3: Get Pre-Approved for a Mortgage

If you want to be seen as a

serious and financially capable buyer

in the seller's eyes, it is important to get pre-approved for a mortgage. Research a mortgage lender that will offer competitive rates, fair loan terms, and has a strong and positive reputation.

Get acquainted with the fixed-rate vs. adjustable-rate mortgages, and the various loans available, like conventional, VA (veterans assist), or FHA loans.

FHA loans are designed for first-time homebuyers and those with lower credit scores, with down payments as low as 3.5%. They are insured by the Federal Housing Administration.

The

Movement Mortgage Community Assistance (MMCA) Program

can grant a first-time homebuyer up to $8,000 toward the down payment and closing costs.

To qualify, you must meet the following requirements:

- You must be a first-time homebuyer with no ownership interest in any other properties

- The home must be your primary residence — no second home or investment properties

- You must currently be living in one of the following eligible markets:

- Atlanta-Sandy Springs-Alpharetta, GA

- Baltimore-Columbia-Towson, MD

- Chicago-Naperville-Elgin, IL-IN-WI

- Detroit-Warren-Dearborn, MI

- Memphis, TN-MS-AR

- Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

- Miami-Fort Lauderdale-Pompano Beach, FL

- McAllen-Edinburg-Mission, TX

- San Antonio-New Braunfels, TX

- Dallas-Fort Worth-Arlington, TX

- Brownsville-Harlingen, TX

- Phoenix-Mesa-Chandler, AZ

- Riverside-San Bernardino-Ontario, CA

- Houston-The Woodlands-Sugar Land, TX

- New York-Newark-Jersey City, NY-NJ-PA

- Washington-Arlington-Alexandria, DC-VA-MD-WV

- Oklahoma City, OK

- Orlando-Kissimmee-Sanford, FL

- Tampa-St. Petersburg-Clearwater, FL

- Cleveland-Elyria, OH

- St. Louis, MO-IL

Download MMCA Program File

To learn more about the mortgage process, check out some of our other blog posts from our partner,

Terry Kravaris at Movement Mortgage.

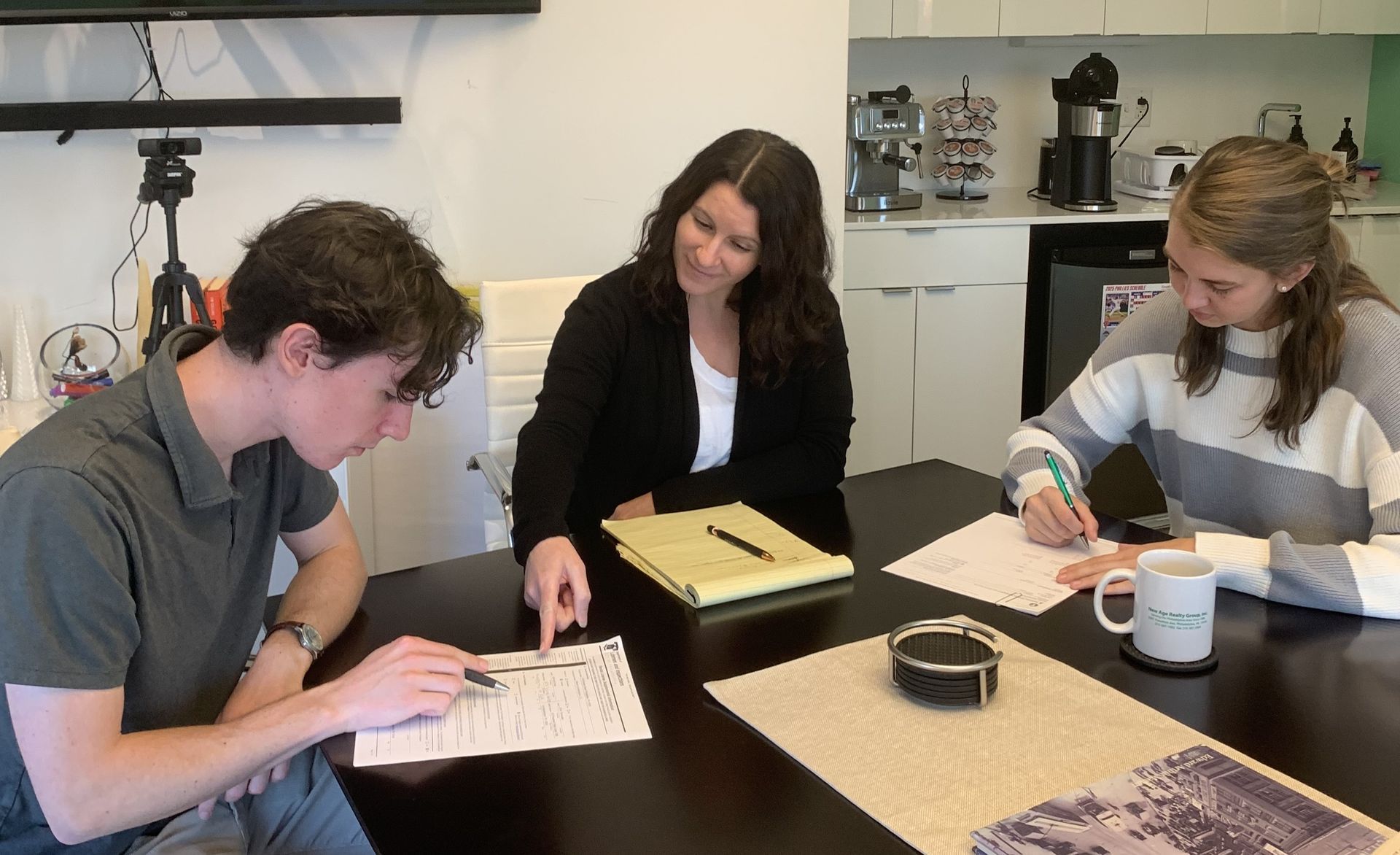

Step 4: Choose Your Real Estate Agent

One of the most important steps of buying your first home is choosing an agent that is the right fit.

Our agents are standing by to assist you in your home purchase! Contact us at 215-387-1002.

A good agent will be your advocate throughout the entire transaction. Look for someone experienced with a proven track record and a positive reputation online. Ask people you trust, like family and friends, for recommendations.

Online listing services like Zillow or Realtor.com can provide some insights into an agent's reputation as well. One step further would be to verify their licensing status through your state's real estate commission website.

We recommend that you

interview multiple agents and collect the following information:

- Experience and Expertise

- Newer agents can be enthusiastic, but experienced agents often have refined negotiation skills and market knowledge

- Some agents specialize in certain types of properties or neighborhoods

- Communication Style

- Nobody wants an unresponsive agent, so note how quickly they respond to your inquiries

- Ensure their communication methods (email, text, call, etc.) align with your preferences

- You'll be spending a lot of time with your agent, so it's important to feel comfortable and trust their guidance

- Understanding of the Market

- Your agent should be well-versed in the neighborhoods you're interested in

- They must have the ability to help you make competitive offers based on current market conditions.

- Services and Fees

- With the ongoing lawsuits involving the

current commission structure, it's important to clarify who will be paying what

- Ask about any additional services your agent offers, like virtual tours or personalized home searches

- Contract Details

- Some agents require you to sign a exclusivity agreement committing to work only with them for a set period

- Ensure there's an option to end the agreement if the partnership isn't working out

Step 5: Researching and Touring Potential Homes

At this point, you can begin researching potential properties that you can call home. But, it's more about just looking at listings online. House hunting can be time-consuming and requires effort.

Since finding a property that meets all your needs is challenging, stay patient, keep researching, and stay in touch with your agent. Decide beforehand what you're willing to compromise on if you find something that fits most of your criteria.

Keep in mind that the seller's agent will provide your agent with a Seller's Property Disclosure Form, which will outline any known issues with the property that must be disclosed.

Utilize listing services like Zillow, Realtor.com, and Trulia to get an idea of what is out there. Your agent has access to the local Multiple Listing Service (MLS) to pull the most up-to-date information, run a Comparative Market Analysis (CMA) to assess a home's asking price and run custom searches for exactly what you are looking for.

Ask your agent to set up automatic emails so you can stay updated on properties that fit your criteria. Your agent may also have knowledge of upcoming listings that have not hit the market publicly.

Take a ride around the neighborhood in which you are looking to get a feel for the community, and in case there are "For Sale" signs up.

Once you have created a list of homes you are interested in, your agent will schedule tours for you and help you navigate any scheduling conflicts. Attend open houses as they pop up, as they give you easy access to the listing agent for questions.

Step 6: Make an Offer and Negotiate

You've decided on a home that fits your needs and budget. It's time to make a formal offer.

Your agent will prepare an Agreement of Sale

outlining all the terms. The key components that make up the agreement are as follows:

- Offer Price: In a bidding war, you may need to submit your highest offer up front.

- Earnest Money Deposit: Typically 1-3% of the purchase price, showing your good faith.

- Financing: How the property will be paid for.

- Proposed Closing Date: This should be far enough out that you can complete inspections, appraisals, etc.

- Personal Property: Items you wish to include, like appliances or fixtures.

- Contingencies: Any conditions that must be met.

What are contingencies

and what are the various types? Contingencies protect you by allowing you to cancel or renegotiate the contract if certain conditions aren't met. They provide a structured way to address unforeseen issues without breaching the agreement.

Common contingencies to include:

- Home Inspection Contingency: Allows you to have the property professionally inspected within a specified time frame. If significant defects are found, you can request repairs, seek a price reduction, or terminate the agreement.

- Financing Contingency: Makes the purchase dependent on your ability to secure a mortgage. If your loan application is denied, you can back out without penalty.

- Appraisal Contingency: Requires the home to appraise at or above the sale price. If the appraisal is low, you can renegotiate the price or terminate the contract.

- Sale of Current Home Contingency: Conditions the purchase on the sale of your existing home. This provides you with time to sell your home without risking two mortgages.

- Title Contingency: Ensures you can obtain a clear title to the property.

- Homeowners Association (HOA) Review: Allows you to review HOA documents and regulations.

Your agent will specify in the offer how long it's valid for, and the seller's agent will present the offer to the seller.

The seller can accept it, reject it, or present a counteroffer.

Stay flexible but know your limits—decide beforehand the highest price you're willing to pay and which terms are non-negotiable.

Responding promptly is key; it keeps the conversation going and shows you're serious.

Keep the communication polite and professional, as a good rapport can make negotiations smoother.

Step 7: The Due Diligence Period: Inspections, Appraisal, & Title

Congratulations! Your offer has been accepted.

Now it's time to schedule a home inspection, order an appraisal, and conduct final due diligence before finalizing the deal (assuming you did not waive any of these).

This is one of the most important parts of the home-buying journey, so take some notes here.

Your agent should have some good recommendations for qualified home inspectors. They will conduct a comprehensive examination of the house, checking everything from the foundation and roof, to the plumbing and electrical systems.

We highly recommend attending the inspection yourself

to learn more about your potential new home and ask questions.

Once you receive the inspection report, make sure you review it thoroughly for all issues found.

Don't be alarmed if the list seems long; even new homes can have minor problems. Focus on significant concerns that could impact your safety or require substantial investment to fix.

Discuss the findings with your real estate agent to determine the best course of action. You might:

- Request Repairs or Credits: Ask the seller to fix specific issues or provide a credit so you can handle the repairs yourself after closing.

- Negotiate the Price: Use the inspection results as leverage to lower the purchase price.

- Proceed As-Is: If the issues are minor or expected, you may choose to move forward without changes.

The lender will require an appraisal, which protects both you and the lender from overpaying for the property.

An independent appraiser will evaluate the home based on factors like location, condition, and recent sales of comparable properties in the area.

If the appraisal confirms the purchase price, you can proceed confidently. However, if it comes in lower than expected, you'll need to revisit negotiations. Options include:

- Price Adjustment: Ask the seller to reduce the price to match the appraised value.

- Increased Down Payment: Cover the difference yourself to satisfy the lender's requirements.

- Walk Away: If an agreement can't be reached and you have an appraisal contingency, you can exit the contract without penalty.

Some additional Due Diligence to consider:

- Additional Inspections: Depending on the property's age and location, consider specialized inspections for termites, mold, or radon.

- Title Search and Insurance: Verify that the property's title is clear of liens or disputes, and secure title insurance.

- Homeowners Association (HOA) Documents: If applicable, review HOA rules, fees, and meeting minutes for any red flags.

A

title search will be ordered, typically within 7 days of the execution date of the agreement of sale. This process verifies that the property title is clear of any liens or disputes. It's crucial because it ensures you won't inherit any legal issues with the property.

You'll also purchase

title insurance, which protects you from future claims against the property's title.

Step 8: Secure Final Mortgage Approval

It's time to focus on securing your final mortgage approval. By solidifying your financing, you are one giant leap closer to buying your first home.

Your lender will likely request some updated documents to ensure your financial situation hasn't changed since pre-approval. Gather your recent pay stubs, bank statements, and any other relevant financial information.

Talk to your lender about

locking in an interest rate that fits comfortably in your budget, as even a small change can impact your monthly payments. Typically, the lock lasts for a set period (like 30 or 60 days) so you have time to reach your closing date.

Review your loan terms thoroughly. Double-check the loan amount, interest rate, monthly payment, and closing costs. If there are any questions, concerns or issues, contact your lender for clarification. It's important to be fully comfortable will all the details before moving forward.

While in this phase,

maintain your financial stability. Avoid making large purchases, opening new lines of credit, or changing jobs. These can affect your credit score or debt-to-income ratio, jeopardizing your loan approval.

Step 9: Prepare for Closing

Finally, you've made it to the home stretch! All the pieces of the home-buying journey will come together at settlement.

First things first, secure homeowners insurance. Lenders require this to protect both your investment and theirs. Shop around to find a policy that offers the coverage you need at the best price. Once you've chosen a policy, provide proof of insurance to your lender.

Approximately

three days before closing, you'll receive the

Closing Disclosure

document. This form outlines all the final details of your loan—interest rate, monthly payments, and closing costs.

Compare it to your Loan Estimate to ensure there are no surprises. If you spot any discrepancies, contact your lender immediately.

As the big day approaches, it's time to

arrange your finances. Confirm the total amount you'll need to bring to closing, including down payment and closing costs.

Typically, this payment is made via a certified check or wire transfer.

Be cautious

and

verify all wiring instructions directly with your closing agent to avoid fraud.

Finally,

prepare for closing day. Gather all necessary documents, like a valid ID and any paperwork your lender has requested.

Double-check the time and location

of your closing, and make sure you know who will be present.

Step 10: Close the Deal

This step involves three key parts: conducting a final walk-through, attending the settlement, and finally, receiving the keys to your new home.

1. Conduct a Final Walk-Through

- Verify Repairs: Ensure all agreed-upon repairs have been completed satisfactorily.

- Check the Condition: The home should be in the same condition (or better) as when you made your offer.

- Test Appliances and Systems: Turn on appliances, run water faucets, and test heating and cooling systems.

If you spot any issues, notify your real estate agent immediately to address them before closing.

2. Attend the Closing Meeting

- Who Will Be There: You, your real estate agent, the seller (or their agent), a closing agent or attorney, and sometimes a representative from the title company.

- Valid Photo ID: Required for identity verification.

- Necessary Funds: A cashier's check or proof of wire transfer for your down payment and closing costs.

- Proof of Insurance: Homeowners insurance policy details.

- Settlement Statement: Breaks down all costs associated with the sale.

- Promissory Note: Your agreement to repay the mortgage.

- Deed of Trust or Mortgage: Secures the loan with the property as collateral.

- Affidavits and Declarations: Various legal statements required by the lender or state law.

3. Receive the Keys

- Ownership Transfers to You: Congratulations, you're now the official owner of your new home!

- Get the Keys: The seller or their agent will hand over the keys, garage door openers, and any security codes.

Celebrate This Moment: You've achieved a major milestone. Take a moment to appreciate all the effort that brought you here.

Step 11: Post-Settlement—Move In and Manage Your New Home

YOU DID IT!

You are officially a first-time homeowner!

This has been a long and likely stressful process, and the only thing left to do is to move in to your new home. Let's go over how to make the move without having too many issues. We'll break step 11 down into 5 sub-steps.

1. Move Into Your New Home

Begin by planning your move. Schedule movers or rent a truck in advance and use this opportunity to declutter by getting rid of items you no longer need. Organize your packing by labeling boxes clearly, which will make unpacking easier.

2. Transfer Utilities and Update Your Address

Contact providers to transfer or set up new accounts starting on your move-in date.

- Water and Waste Services:

Arrange for water, sewage, and trash collection services.

- Internet and Cable:

Schedule installation appointments ahead of time to avoid delays.

- Notify the Post Office:

Submit a change-of-address form to forward your mail.

- Financial Institutions:

Banks, credit card companies, and investment accounts.

- Employers and Schools:

Ensure your workplace and your children's schools have your new address.

- Subscriptions and Memberships:

Magazines, streaming services, and gym memberships.

- Update Driver's License and Vehicle Registration:

Check local requirements for updating your records.

3. Secure and Personalize Your Home

Security is paramount. Change the locks to ensure only you have access to your home. Consider installing a security system for added peace of mind, and check that smoke detectors and carbon monoxide alarms are functioning properly.

4. Maintain Your Investment

Being proactive with maintenance can save you time and money in the long run. Start by setting up a maintenance schedule that includes regular inspections of your HVAC systems, plumbing, and roofing.

Don't forget seasonal tasks like cleaning gutters, servicing heating and cooling systems, and preparing your home for weather changes.

Budgeting for these expenses is essential—establish an emergency fund for unexpected repairs and factor in ongoing costs such as property taxes, homeowner’s insurance, and utility bills.

Additionally, review your homeowner’s insurance periodically to ensure your coverage reflects any new purchases or improvements, and consider shopping around to compare insurance rates and secure the best deal.

5. Get Involved in Your New Community

Start by meeting your neighbors—a friendly hello goes a long way in building good relationships. Building connections enhances your living experience.

Attend community events like local gatherings, festivals, or homeowner association meetings to become more involved in your community.

Explore the area to discover local spots and find your new favorite restaurants, parks, and shops. Engage with local organizations by volunteering or joining clubs that interest you, which can help you feel more connected and enrich your social life.

Step 0: Let's Get Started

Contact Team New Age today to begin your homebuying journey!

Embarking on the journey to homeownership is an exciting milestone filled with anticipation and countless decisions

But remember, you don't have to go through this journey alone.

At New Age Realty Group, Inc. we're dedicated to making your first-time homebuying experience as smooth and enjoyable as possible.

Our team of professionals with over 150 years of combined real estate experience is here to guide you every step of the way—whether it's finding the perfect home, securing the best financing options, or settling into your new neighborhood.

Looking for a home in Philadelphia and ready to take the next step?

Let us help you turn the keys to your new house and open the door to a brighter future.

Contact us today at 215-387-1002 or sales@newagerealtygroup.com to discover how we can make your homeownership dreams come true.

Your dream home is waiting—let's find it together!